Value Added Tax System of Bangladesh (Act, Rules and Procedure) (Hardcover)

Category: Law and Justice Others book on law

Value Added Tax System of Bangladesh: Liton Publications

Explore our products and add items to your cart.

| Sub-Total : | ৳0 |

Category: Law and Justice Others book on law

Value Added Tax System of Bangladesh: Liton Publications

| Title | Value Added Tax System of Bangladesh (Act, Rules and Procedure) (Hardcover) |

|---|---|

| Publisher | Liton Publications |

| Edition | 2020 |

| No. Of Pages | 512 |

| Country | Bangladesh |

| Language | English |

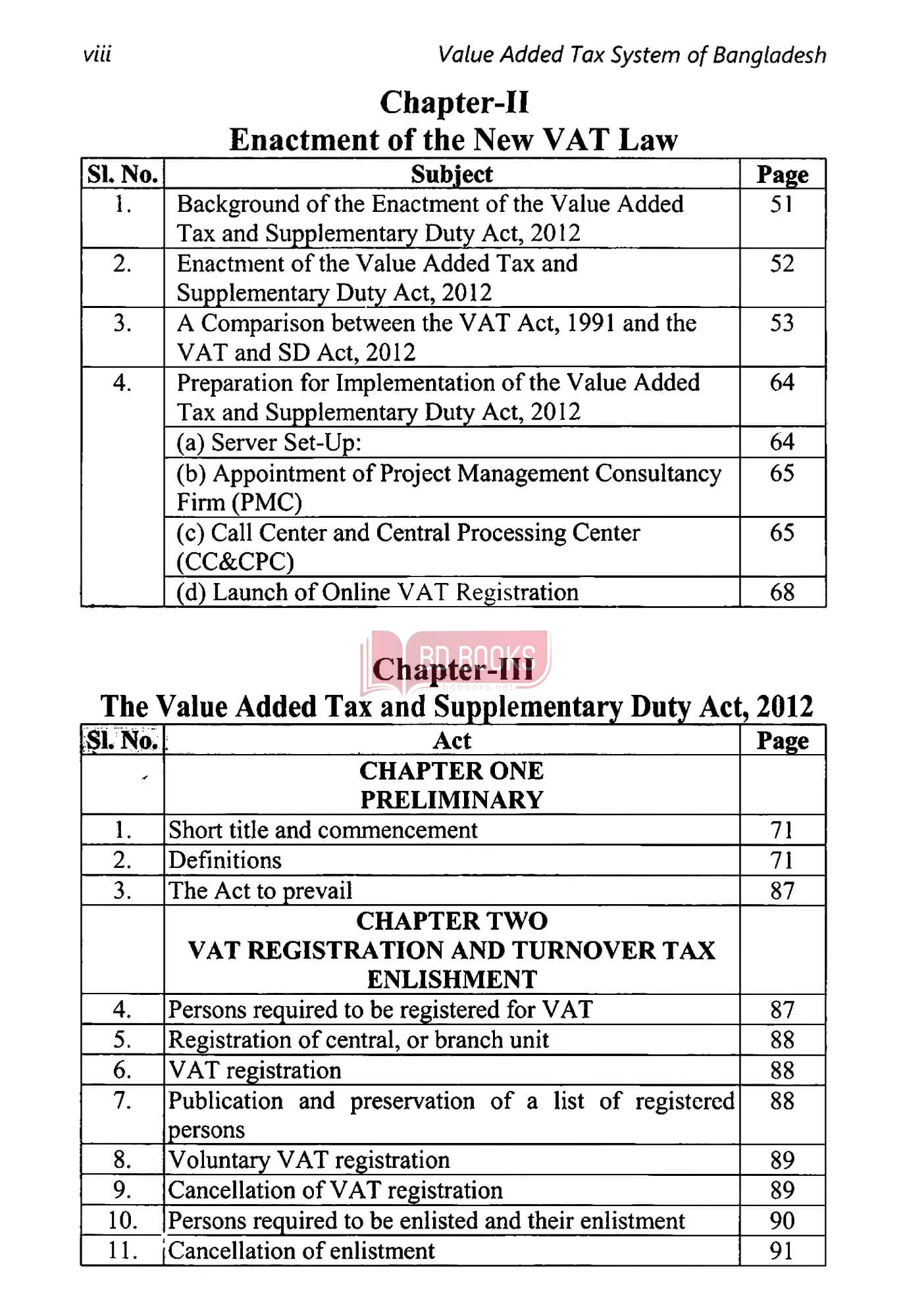

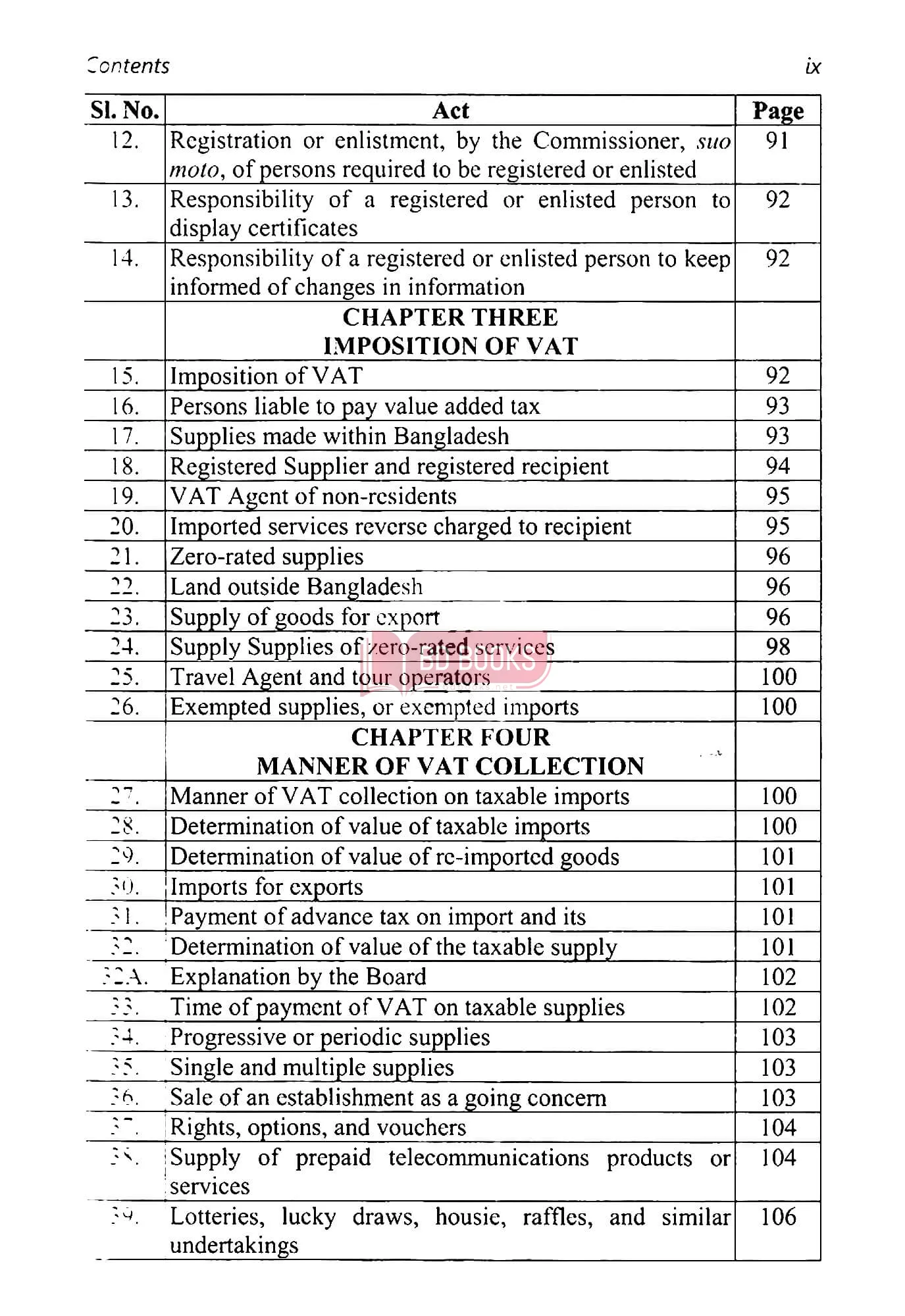

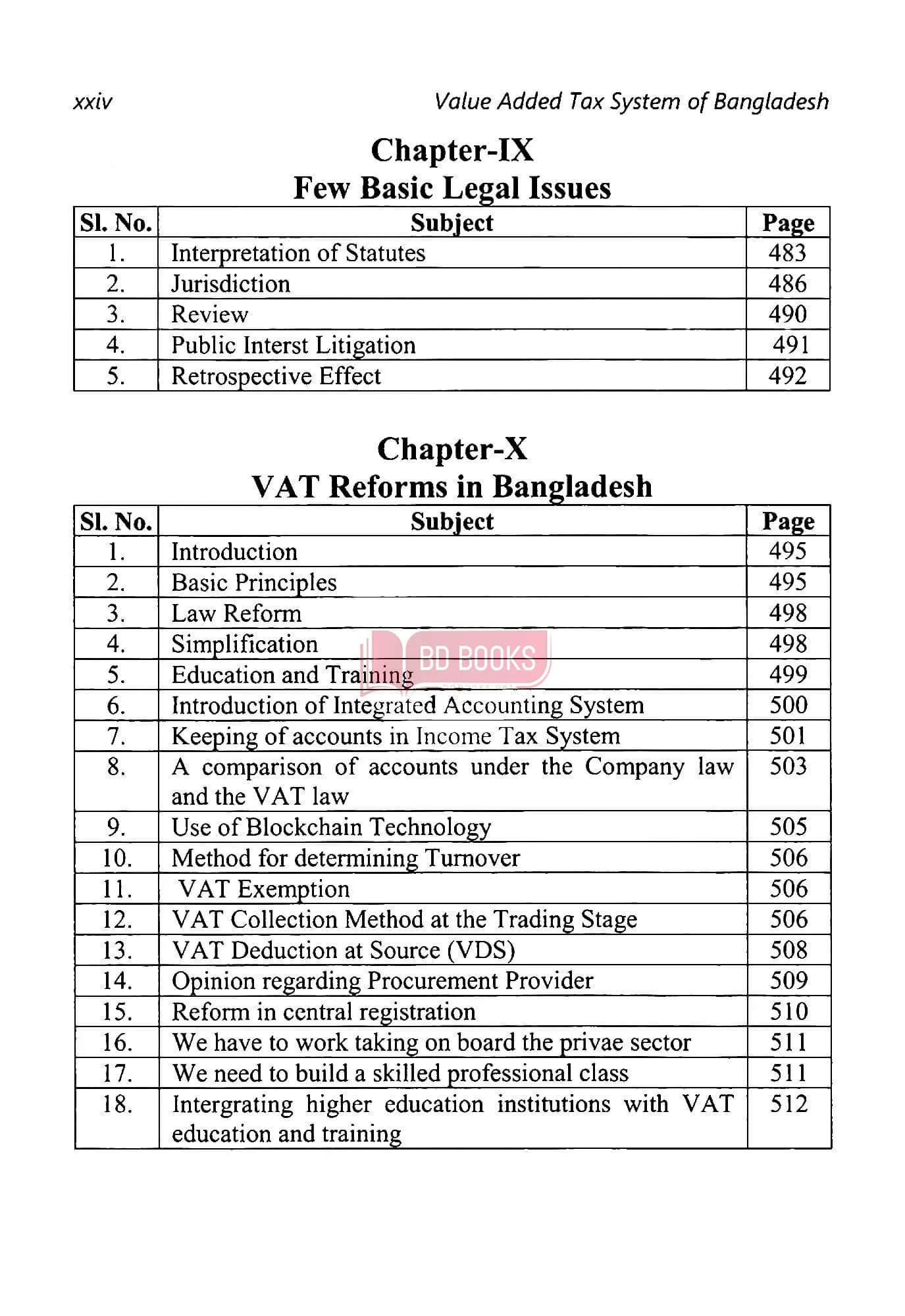

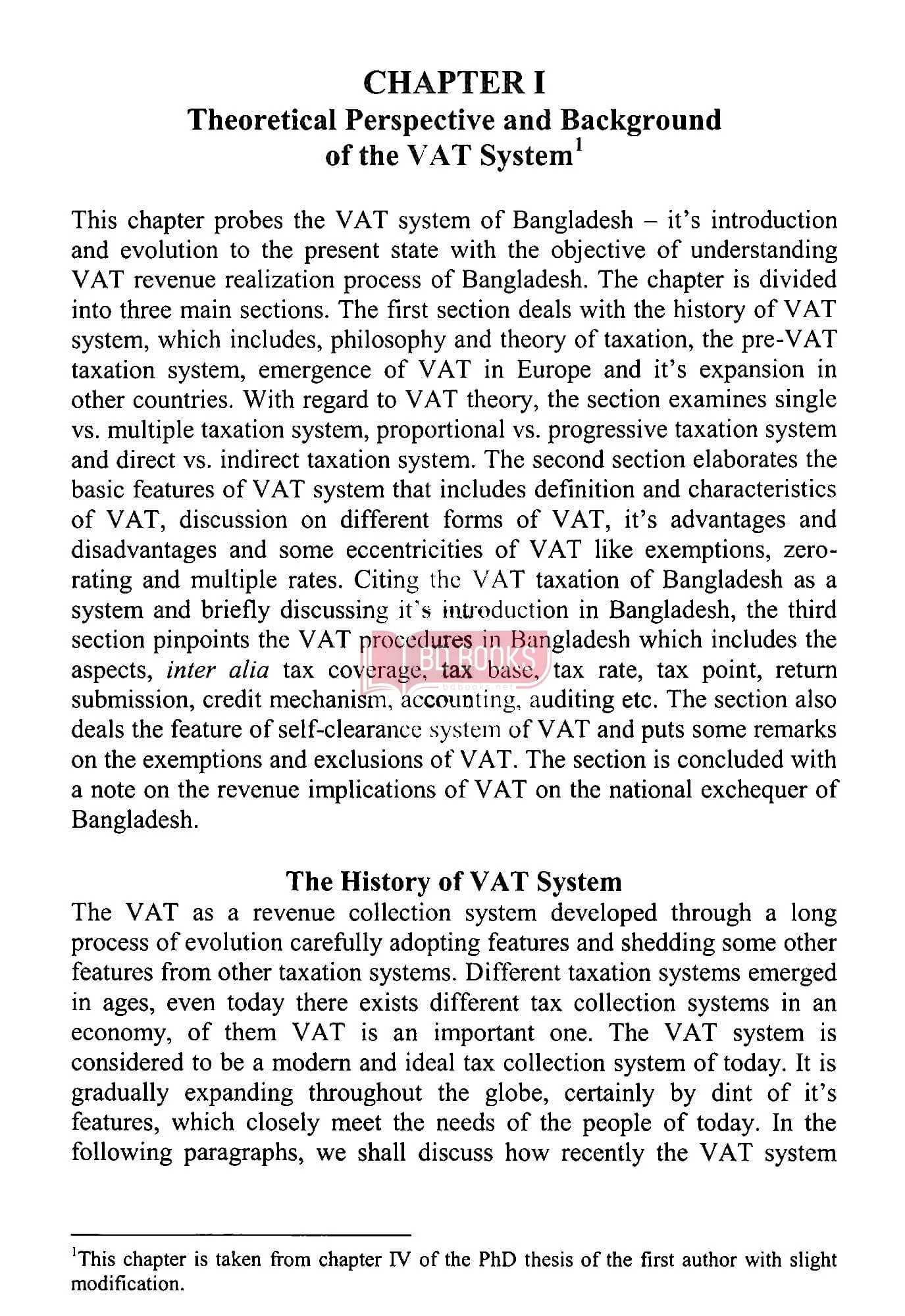

| Description | Preface to the Fourth Edition There are some readers including foreigners working in Bangladesh who require VAT contents in English. The third edition of the book was published in January 2019 when the Value Added Tax Act, 1991 was in force. Meanwhile, the VAT and SD Act, 2012 has become effective from 1 July 2019, so there required major changes in almost all chapters of this book. I wanted to publish the book soon after the passage of the Finance Act, 2020 following publication of my Bangla book "Shohoj Bhashai Notun VAT Ain". But Covid-19 caused the delay. Alhamdulillah, overcoming the challenges the book has seen the lights of the day. In this edition, for advantage of the corporate readers in particular, 14 SRO's/GO's which are frequently needed to perform VAT works have been included translating in English. New chapters have been incorporated on theoretical perspective of VAT, enactment of the new VAT law and VAT reforms. We want to achieve developing country status by 2024, want to achieve Sustainable Development Goals (SDGs) by 2030, want to become higher middle-income country by 2031 and by 2041, we want to become a prosperous, developed country. Our Second Perspective Plan 2021-2041 envisages 24% tax-GDP ratio by 2041. VAT is a potential sector for increased revenue mobilization. A simplified VAT regime can ensure establishment of a standard VAT system ensuring generation of enough domestic resources to finance development. Many friends, well-wishers and VAT enthusiasts encouraged and helped in various ways to bring the book to light. Barrister Faria Huq made major contribution in translating from my Bangla version book, the contents of question and answer chapter, enactment of the new VAT law chapter, trade VAT chapter, reform chapter and in some other areas. So, her contribution has been recognized considering her as a co-author of the book. Mr. Arshed Ali, VAT Consultant and VAT Agent, Md. Rakibul Hasan, MD & CEO, Endorser International Business Consultants and Md. Jubayed Rahman, ACCA, Manager (Taxation), Daraz Bangladesh Ltd. were of enough help to complete the book. I express my deepest gratitude to all of them. Suggestions to improve the book shall be welcome which can be sent to roufvat@gmail.com and faria.huq.ashna@gmail.com. DR. MD. ABDUR ROUF |

"Your personal data will be used to enhance your website experience, manage account access, and fulfill other described purposes in privacy & policy".

Chat with us